Does Japan's national consumption tax revenue fund subsidies for firms engaged in exporting goods and services? No, that's not true: The consumption tax, known as a value-added or sales tax, has been around since 1989 and it provides a source of tax revenue used mostly to fund domestic social security needs. Companies that export goods and services may be exempt from paying consumption tax on their exports.

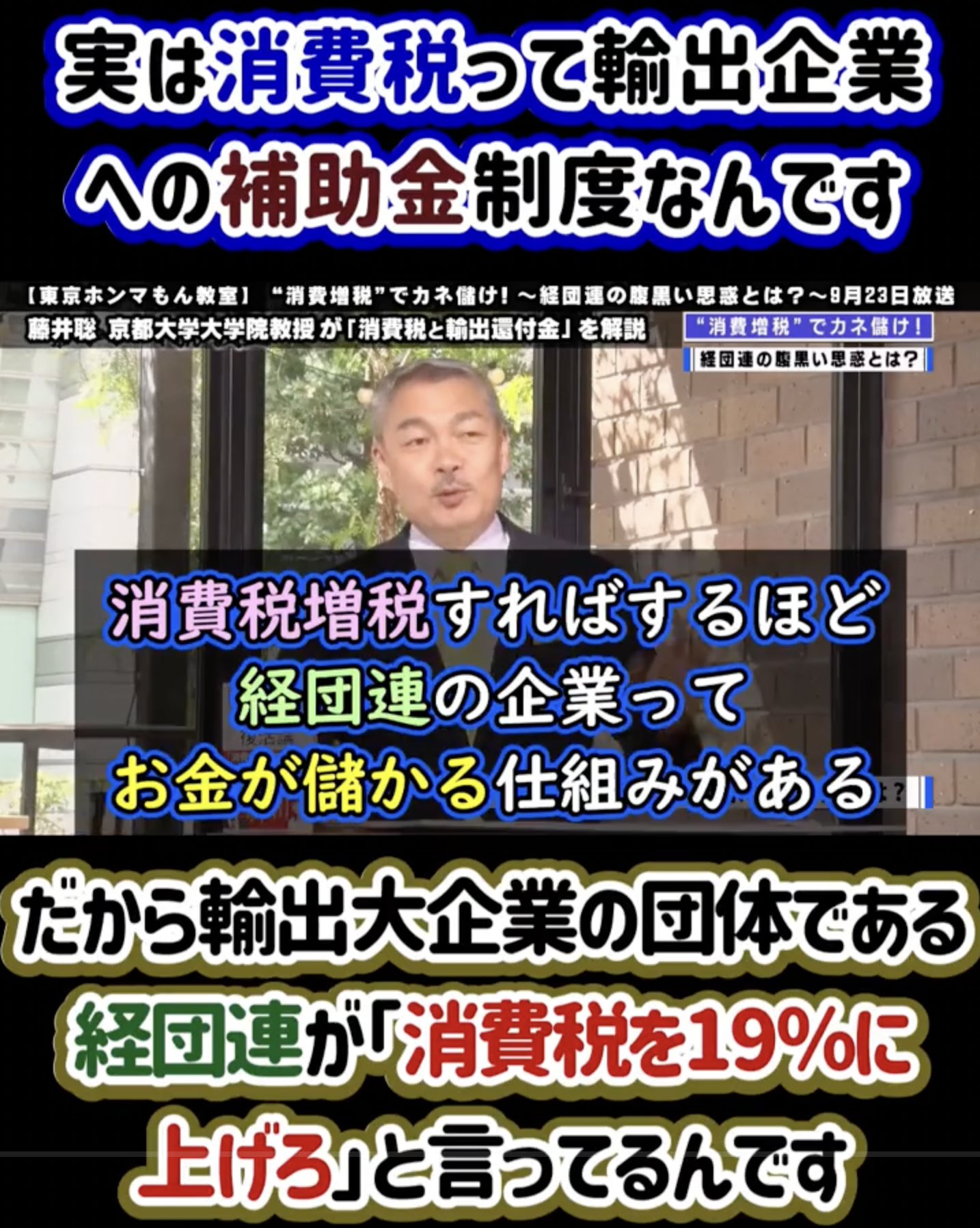

The claim appeared on TikTok (archived here) on October 8, 2023, with a caption translated into English from Japanese by Lead Stories staff that reads:

The truth is the consumption tax is levied as a subsidy for exporting companies. That's why the largest association of exporting companies, the Japanese Business Federation, proposed to increase the consumption tax from 10% to 19%.

This is what the post looked like on TikTok at the time of writing:

(Source: TikTok screenshot taken on Tue Oct 10 02:04:31 2023 UTC)

The consumption tax was introduced in 1989 at a rate of 3% following the economic boom in Japan. As goods and services were being exchanged at a higher concentration than ever before, the Ministry of Finance and METI (Ministry of Economics, Trade, and Investment) passed the consumption tax as an additional source of government revenue. Today, the revenue that comes from the consumption tax is being used for social security, and its existence is justified by the Ministry of Finance as a stable revenue source that is less directly impacted by the fluctuations and changes in the economy.

The consumption tax rate has been raised to 10% since October 1, 2019 for most goods and services and a reduced tax rate of 8% is applied to sales of food and beverages, except for alcoholic drinks and dining out. This raise has been decided as a measure to help reduce the national debt.

The claim that the Japanese Business Federation had asked for the consumption tax to be raised from 10% to 19% is an existing, internet hoax that stemmed from Twitter users poking fun at Prime Minister Kishida's proposal to increase the current consumption tax from 10% to 15%.