Do people born in the 1960s and later lose money paying for their pension? No, that's not true: The Ministry of Health, Labor and Welfare states that if you live an average long life, the total amount of money you will receive through your pension during your lifetime will be greater than the total amount of insurance premiums you paid, so your money is not wasted.

The claim appeared on a TikTok video (archived here) on April 11, 2024. Translated from Japanese to English by Lead Stories staff, It opened:

This doesn't make sense!

If it is a loss, why should we pay?

The pension system is bankrupt.

This is what the post looked like on TikTok at the time of writing:

(Source: TikTok screenshot taken on Tue Apr 23 14:33:21 2024 UTC)

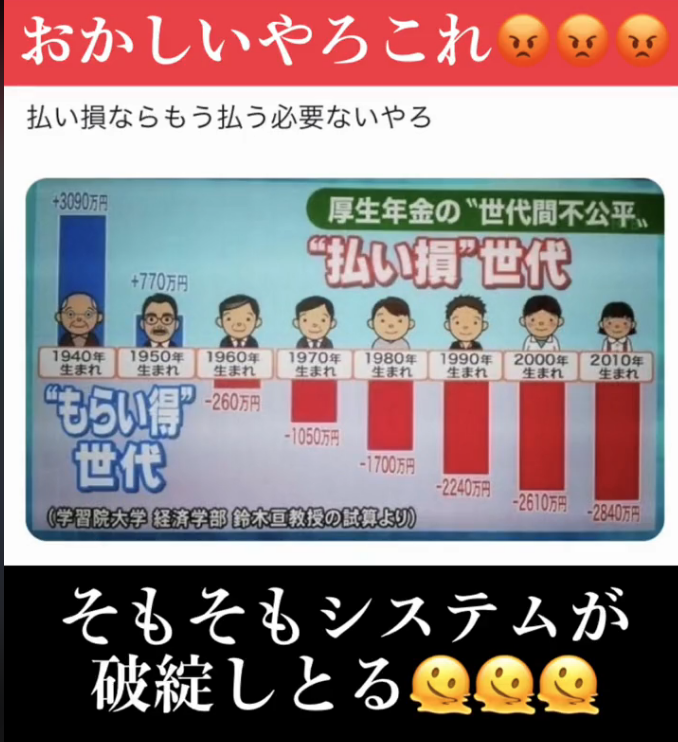

In Japan, one-third of the national pension is paid by the National Treasury, so you can receive benefits that exceed the insurance premiums you paid (archived here). According to calculations by the Ministry of Health, Labor and Welfare, if someone born in 1985 pays into the pension system for 40 years and receives benefits from age 65 to 87, the amount of pension they will receive will be more than 1.7 times the amount of the premiums they paid (archived here).

(Source: Screenshot taken on Mon Apr 29 13:30:41 2024 UTC)

The average life expectancy of Japanese people (81.05 for men and 87.09 for women) (archived here) is expected to continue to increase, and there is growing concern about living expenses in old age. The national pension is meant to be a lifelong guarantee that you can receive a pension as long as you live.

The national pension is not only for old age but also for those who are left with disabilities due to accidents or illness; for those who die, a "Basic Disability Pension" is paid to their surviving family members.

The insurance premiums paid are fully deductible as "social insurance premium deductions," which reduce taxes (archived here).

The pension system is not bankrupt, as claimed in the TikTok video (archived here). In national pensions the insurance premiums paid by the working generation are the main source of funds: this method of managing pensions is called the pay-as-you-go system. Under this system, pensions will not disappear as long as there are people working and contributing, and the Japanese economy does not collapse. On top of that, mechanisms have been introduced to make the system sustainable in the future, even if the population continues to age and the birth rate declines (archived here).

All this should not be confused with whether or not the pension system is profitable. The burden of future insurance premiums becomes heavier for younger generations. The amount of public pensions is revised according to wages and price levels, it is an adjustment mechanism to match the demographic changes in place and is called a "macroeconomic slide" (archived here). Because of the "macroeconomic slide," it is true that the relationship between the burden and benefits of the pension system varies from generation to generation.

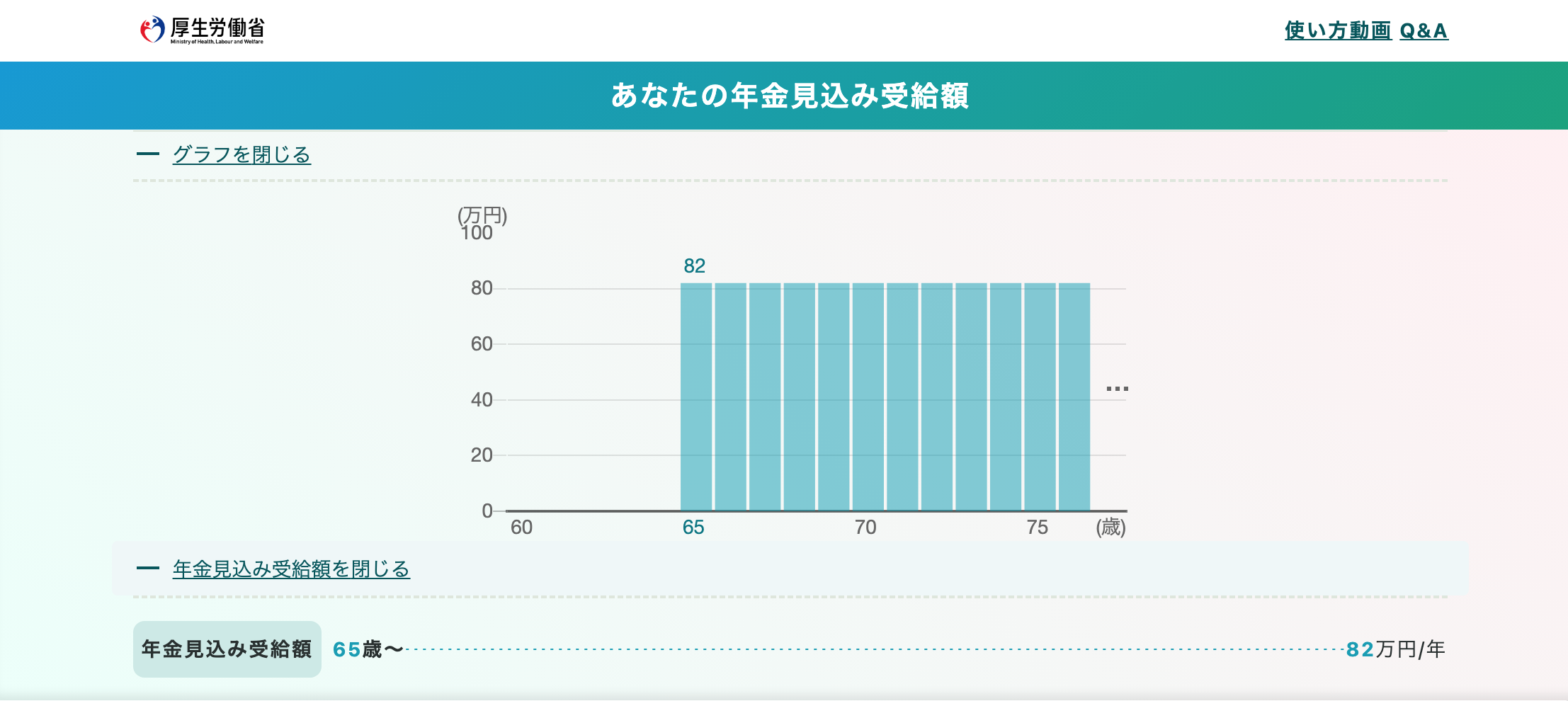

The "pension simulator" is a tool that allows you to easily estimate what pension you will receive in the future according to changes in your work and lifestyle, available from the Ministry of Health, Labor and Welfare.

According to the pension simulator, for example, the estimated pension amount for people born in the 1960s is 820,000 yen per year. If you consider this from age 65 to 87 (22 years), the total amount is 18,040,000 yen. The total insurance premium is about 8,300,000 yen, so the actual pension amount you receive is about 2.17 times the amount of the premium you paid.

(Source: Screenshot taken on Tue Apr 30 22:47:40 2024 UTC)